Moving towards systems change: The ‘Why’ of Impact Investing

July 06, 2020 - By Patrick Briaud and Steven Godeke

The following is an excerpt from Rockefeller Philanthropy Advisor’s forthcoming Impact Investing Handbook: A Practitioner’s Guide to Impact Investing.This blog was originally posted on www.impactalpha.com.

In the decade since Rockefeller Philanthropy Advisors published a pair of guides to the nascent practice of impact investing, the field has evolved dramatically. New and sometimes unlikely players are developing new themes and impact lenses, from place-based investing to the creative economy, and gender lens investing to racial justice. These motivations – the ‘Why’ of impact investing – drive their strategy and implementation.

Given the monumental challenges of systemic racism, climate change, and other pressing issues, tinkering around the edges is no longer enough. A growing number of impact investors are seeking to affect real systems change. The last few months have transformed the ivory tower idea of systems change to one that is both tangible and visceral. Unfortunately, Wall Street does not seem to have noticed the major social and environmental movements confronting Main Street. How can impact investing play a role in connecting the two?

Movements, Systems Change and Markets

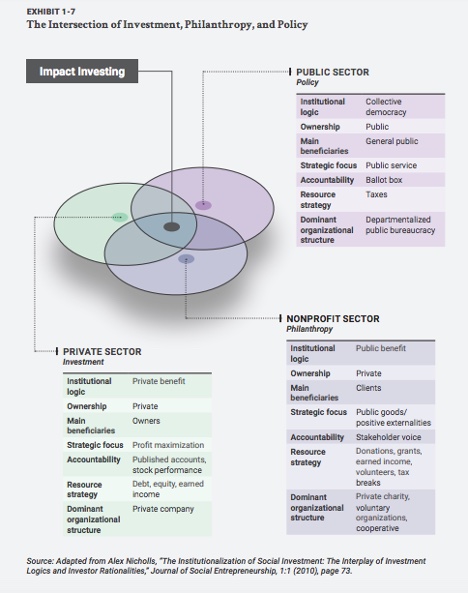

Our world has become more integrated, but frameworks and practices remain largely separate—with the private sector actors, policy makers, and philanthropists staying in their own lanes. Sitting at the nexus of investment, philanthropy, and policy (Exhibit 1-7), impact investing combines the distinct institutional elements of these sectors. The interaction of policy, philanthropy, and investment is not new, but understanding the distinct attributes of these sectors is essential for the structuring of effective impact investments.

Impact investing has emerged out of social and environmental movements as well as the intention of investors to use investment tools to shift systems and drive positive change. One important example is divestment from South Africa in the 1980s in order to change the apartheid system. More recently, we have seen the expansion of specific investment lenses to engage systemic issues.

Many people believe that the complex challenges and “wicked problems” facing the world today can only be solved through integrated approaches to policy, philanthropy, and investment. Systems change is about addressing the root causes of social and environmental problems, which are often complex and embedded in networks of cause and effect. It is an intentional process designed to fundamentally alter the components and structures that cause the system to behave in a certain way.

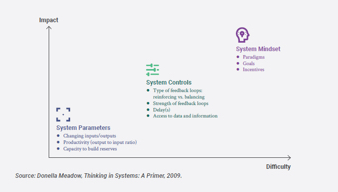

Those who want to shift or disrupt at a systems level seek to find leverage points that can have a big impact, which can link to specific issues they care about. Leverage points range from shallow parameters that are more mechanistic to system design features, such as social structures, rules, and policies, and finally to the deepest leverage points—people’s mental models, beliefs, values, and assumptions—which, in turn, shape structures and patterns in society.

Where does impact investing come in? Intentionally or not, investors change systems.

Impact Themes and Lenses

To apply systems thinking to a portfolio, impact themes and lenses are the means to sort and organize the deployment of your investment capital in alignment with your impact goals. These two categories tend to cluster around specific issue areas and impact goals. For example, the impact theme of financial inclusion may align with the impact goals of empowering women, economic equality, and community development.

Theme: An impact theme can be a specific industry sector, such as energy or health, or can focus on a specific issue, such as community development or social justice. Sometimes these themes may be divided into sub-themes.

Lens: An impact lens is a specific view or perspective applied across all of an impact investor’s assets. For example, a foundation may apply a racial-equity lens to all its investments. This means that the foundation will consider how the investments affect the underlying conditions of racial equity.

Examples of Impact Lenses include:

Gender: Suzanne Biegel of Catalyst at Large shares how “an investor focused on a gender lens would take a broader ‘viewfinder for opportunity or risk’ in all of its investments, whether they explicitly address gender or not.” Biegel suggests specific gender considerations for investors, including leadership and board gender balance, pay equity, parental leave, harassment policies, and supply chains.

Creative Economy: Building on the gender-lens movement, Laura Callanan of Upstart Co-Lab saw the dearth of investment in arts in culture, despite the fact that the “creative economy” makes up 3% of global GDP. The investible universe includes ethical fashion, sustainable food, social-impact media, as well as creative business and places.

Your Theory of Change

Many asset owners and their advisors have a solid grasp of their “Investment Why,” which shapes their specific investment goals – including risk tolerance, liquidity, diversification, and tax minimization. To mirror investment goals, impact goals should be established and integrated. Impact goals may be driven by an asset owner’s heritage, family, faith, legacy, or experience. These goals can aim to leverage specific approaches, including innovation, awareness raising, and direct service. Your impact goals are then merged with your investment goals to arrive at your Theory of Change.

The Theory of Change is tool will serve as the articulation of your intended objectives, how you think they will be achieved, and why you believe it to be so: If we provide x support, we believe y and z will happen.

A theory of change can be useful for your impact investing strategy in several ways. First, it can help describe and interpret—for you, your advisors and partners, and other stakeholders—what you are seeking to achieve, and why. In this way, a theory of change can serve as a communications tool to align and manage expectations. Working through a portfolio-level theory of change can inform portfolio construction in terms of themes, instruments, and partnerships. It can also identify gaps and issues that require further validation, as you prioritize how you seek additional research and evidence. A theory of change should also inform the selection of methods, indicators, and standards that you can use to measure and evaluate success, while aligning short- and long-term measurement efforts

As part of our research, we spoke with a group of leading impact investment advisors about how they work with clients to develop and articulate impact themes, create theories of change, and ultimately construct portfolios that reflect these impact goals. Here are some highlights:

- A shift from themes to theories of change means a shift from sectors to actions, resulting—for example—in looking at poverty alleviation rather than the financial inclusion sector;

- By going deep on specific outcomes, understanding your priorities becomes critical and real-live examples are key in testing and setting these priorities;

- Take an expansive rather than a narrow perspective when developing your theory of change, as many impact goals and themes are interconnected. Multiple pathways exist for creating impact, rather than just one “magic bullet”;

- Developing a theory of change is a repetitive process that requires data in order to be effective—be both courageous and iterative;

- The ability of an advisor to work with you to develop a theory of change has become an essential part of impact investing services;

- Organizations may distinguish between their organizational mission and their impact theory of change; and

- Impact theories of change will not deliver clear black and white answers and need to be informed by social science and research that may not align with your interests and passions.

For example, our hypothetical asset owner, Sophia, wants to prioritize impact themes of water, climate, and the arts, in that order. Where possible, she would also like to overlay a gender lens. She has segmented her assets into three categories, resulting in the following theory of change.

The handbook is designed to give asset owners a roadmap for thinking about these challenging questions, with step-by-step instructions and exercises for taking a theory of change and turning it into reality. By empowering those with capital to invest for impact, it is our belief and our hope that together we can achieve meaningful systems change.

We need to collectively rethink the role of capital in driving positive change, not just investor by investor or portfolio by portfolio, but as a system.

Steven Godeke is founder of Godeke Consulting. Patrick Briaud is senior advisor, impact investing, at Rockefeller Philanthropy Advisors. This post is an excerpt from the new Impact Investing Handbook: A Practitioner’s Guide to Impact Investing from Rockefeller Philanthropy Advisors. Click here to receive the full open-sourced guide.

Back to News