Government Enterprise Empowerment Program (GEEP) Operations

The GEEP program was launched as one of Nigeria’s National Social Investment programs under the management of NSIO to alleviate poverty by providing access to funds for Nigerian entrepreneurs who will otherwise struggle. This program was launched with two broad objectives:

- Access to funding: provide microloans in an easily accessible way to those at the bottom of the pyramid who engage in commercial activities but face significant challenges with access to finance/credit

- Financial inclusion: through these microloan offers and access to finance, ensure that the beneficiaries are brought under the formal financial sector and can further seize the opportunity to access other credit products from financial service providers.

Consequently, GEEP launched three products namely: MarketMoni, TraderMoni, and FarmerMoni. In its literal meaning, these names were coined from the pidgin language understood by Nigerians. Evaluation reports are available on request.

- MarketMoni – “money for the market” – a loan scheme that provides interest & collateral-free loans to SMEs within established market association clusters.

- TraderMoni – “money for traders” – a microloan scheme that provides interest & collateral-free loans to petty traders & artisans in Nigeria.

- FarmerMoni – “money for farmers” – a loan scheme targeted at farmers belonging to aggregator farming groups.

Read more here on the GEEP’s website.

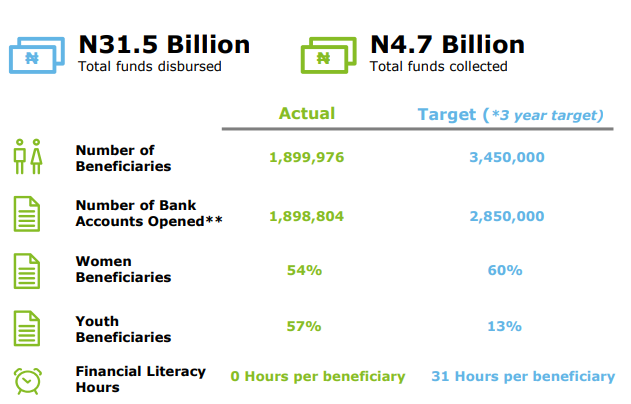

Through the support from The Bill and Melinda Gates Foundation, with RPA functioning as its fiscal sponsor, upon inception in May 2016, amongst the provision of other technical assistance, an operating plan was commissioned for GEEP, and a COO hired. Also, in its first tranche often called “GEEP 1.0”, GEEP, recorded achievement across its product portfolio, a summary of which is provided in the figure below:

The metrics above showed a considerable representation of beneficiaries within the women and youth category. However, the need to focus on improving performance towards financial literacy, collections, and overall financial inclusion became clearly imperative.

Consequently, to ensure that lessons learned from GEEP 1.0 were taken into consideration and data garnered guided decision making towards impact and sustainability of GEEP 2.0, RPA in collaboration with the Bank of Industry conducted an evaluation/assessment of GEEP’s activities to capture the evolution, key successes, challenges, and assess the financial sustainability of the program. Insights from the study led to key recommendations for GEEP which guide its operations to date.

GEEP Covid-19 Survey Reports

Early 2020, the world faced the dual shock of a global pandemic (Covid-19), leading to an economic shutdown. In order to understand the impact of the Covid-19 pandemic on the lives of GEEP beneficiaries, RPA through its consultant 60 Decibels, conducted a survey of GEEP beneficiaries to understand beneficiaries’ experiences, how they were adjusting to the crisis, and garner insights on how best to support them.

The survey entailed 18 rounds of data collection f(twice per month) from August 2020 to May 2021 from beneficiaries across Nigeria’s six(6) geopolitical regions, to understand direct Covid-19 pandemic impacts on households, earning, income, spending habits, financial situation etc. and identify areas of opportunities for high-impact interventions. Over 100 responses were targeted per survey round.

Following survey findings, reports were developed and published. Through these reports, GEEP and other ecosystem stakeholders (public sector decision-makers, policymakers, academia, development partners, DFIs, FinTechs etc.) can identify key areas of intervention for improvement. Reports provided include standard reports for each round and customized reports, enabling researchers to search the data dynamically to develop their reports for decision making.

Key findings from the survey are highlighted below:

- Coping Mechanisms: Across rounds, savings emerged (about 75 – 98% of respondents confirmed) as a top coping mechanism for respondents, with a small proportion (between 13-16% of respondents) using more drastic mechanisms such as selling off assets and borrowing from both the formal financial sector and social networks (28 – 35%) – a worrying note on how COVID-19 has compromised household resilience. However, along these mechanisms, 10% of respondents were able to find new income sources to manage the period.

- Impact on Business Income: Respondents report a persistent concern about COVID-19, driven by an inability to work or earn income. 4 in 5 beneficiaries (over 80%) have suffered a reduction in income.

- Impact on Farming: Across rounds, FarmerMoni beneficiaries have struggled to acquire inputs and manage with tighter finances. At the last round, 40% of farmers noted that they were unable to acquire inputs, while over 55% admitted to limited finance as a challenge to their farming practice – this provides an opportunity to either expand credit to farmers or work with input providers to tie their products to funding.

- Impact on Business: Unsurprisingly, impact and lockdown were closely correlated. Given the low demand and supply stemming from closure due to movement restrictions, most beneficiaries experience low income. The government reopening on September 30, allowed business owners the flexibility and freedom to re-open and re-hire employees. At its low point in round 3 (September 30 – October 9, 2020), only about half of employers (49%) were able to cover employee salaries, now 4 in 5 (78%) can do so.

- Food consumption and Hunger: There’s been a reduction in consumption and a rise in hunger. Respondents consume less than they did and are more likely to experience hunger today than before the pandemic. Despite high reports of decreased consumption at the beginning of the project, the most extreme reports dropped by half over the course of data collection. At the last round in May 2021, over 55% admitted to a decrease in food consumption in their households. On average, 3 in 5 respondents went hungry when they wouldn’t normally.

- Cash Accessibility: Compared to the first round of data collection in August 2020, survey findings continue to show a rise in ease of access to cash among clients. 29% of beneficiaries said it was “very easy” to access cash in August 2020, but in round 18 (in May 2021), 57% admit that access to cash has become “very easy”.

- Loan Repayment: Findings show loan repayment as a heavy burden for beneficiaries. More than 3 in 5 active GEEP beneficiaries explained that they struggled to repay their loan.

- Overall Financial Situation: Households report a worsening in their financial situation since the beginning of the pandemic, highlighting the long-lasting nature of the crisis. At the last round of data collection in May 2021, over 90% of respondents reported a “worse” situation since the pandemic started.

Full reports can be accessed and downloaded here.